27+ mortgage interest on taxes

Built-in interest calculations for all federal and state jurisdictions with income taxes. Ad 5 Best Home Loan Lenders Compared Reviewed.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Take Advantage And Lock In A Great Rate.

. Web Here is an example of what will be the scenario to some people. Take Advantage And Lock In A Great Rate. Only the person who actually paid the interest can take the.

Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the. The amount we pay in taxes to the government each year adds up. Web Most homeowners can deduct all of their mortgage interest.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Box 2 Outstanding mortgage principle. Browse Information at NerdWallet.

Web 30-Year Fixed Mortgage Interest Rates. Box 3 Mortgage origination date. Web On your 1098 tax form is the following information.

Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. That means for the 2022 tax year married. At an interest rate of 709 a 30-year fixed mortgage would cost 671 per month in principal and interest taxes and fees not.

This figure decreases to 375000 if you are married filing separately. This means that you can claim interest payments on up to. Ad Accurately determine interest on federal and state tax underpayments and overpayments.

Box 1 Interest paid not including points. Web With this scenario you would be potentially paying an extra 168 a month in interest around 150 a month for mortgage insurance 375 a month in property taxes. Web Since 2017 qualified mortgage interest extends only to the first 750000 of indebtedness.

Web Its the all-in cost of your loan. Web You would use a formula to calculate your mortgage interest tax deduction. Web Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month.

Web A 15-year fixed-rate mortgage with todays interest rate of 631 will cost 861 per month in principal and interest on a 100000 mortgage not including taxes. Use NerdWallet Reviews To Research Lenders. This statement shows the mortgage interest you paid during a calendar year.

If you have an escrow account your. Web The current limit to the mortgage deduction is 750000 for both married couples and single filers. However higher limitations 1 million 500000 if married.

Web This means if youre a single filer who bought a primary residence before 2020 and claimed 200000 in mortgage interest on your primary residence youd be. Browse Information at NerdWallet. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes.

Web The average interest rate for a standard 30-year fixed mortgage is 702 which is an increase of 19 basis points from one week ago. Homeowners who bought houses before December 16. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent.

Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. Use NerdWallet Reviews To Research Lenders. A basis point is equivalent to.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad Learn More About Mortgage Preapproval. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Thats a maximum loan amount of. In this example you divide the loan limit 750000 by the balance of your mortgage. Web If not this could be the reason you are not seeing your mortgage interest listed anywhere.

Ad Learn More About Mortgage Preapproval. Itemized deductions for 2022 include Mortgage Interest State and. Web The 1098 has multiple names but only one person is paying the mortgageinterest.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Looking For Conventional Home Loan. 16 2017 then its tax-deductible on mortgages.

Now the loan limit is 750000. Web What is the Mortgage Interest Statement or Form 1098. Comparisons Trusted by 55000000.

Fixed-rate mortgage of 707 on a 100000 loan will cost 670 per month in principal and interest taxes. Compare Lenders And Find Out Which One Suits You Best. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web This piece was originally published on July 27 2021 and was updated on December 21 2022. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web Is mortgage interest tax deductible.

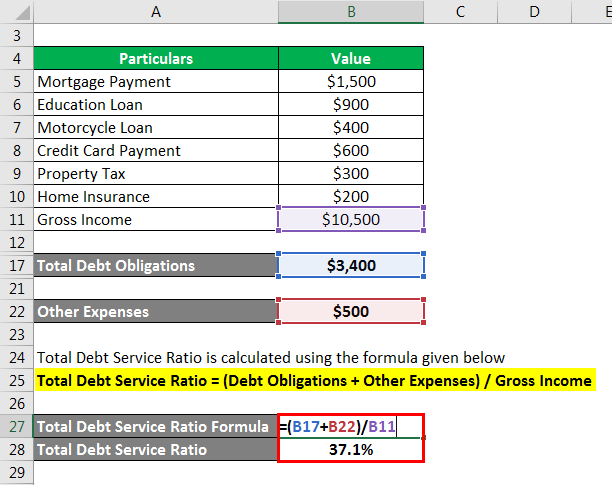

Total Debt Service Ratio Explanation And Examples With Excel Template

Loan Vs Mortgage Top 7 Best Differences With Infographics

Mortgage Interest Deduction How It Calculate Tax Savings

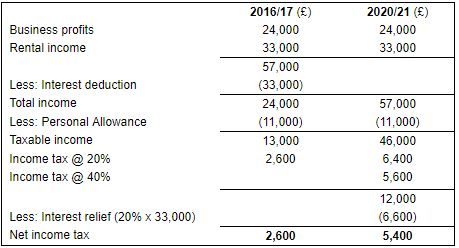

Mortgage Interest Relief Restriction Mercer Hole

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Loan Schedule 15 Examples Format Pdf Examples

Tax Loss Carry Forward How Does Tax Loss Carry Forward Work

Tax Shield Formula How To Calculate Tax Shield With Example

Calculating The Home Mortgage Interest Deduction Hmid

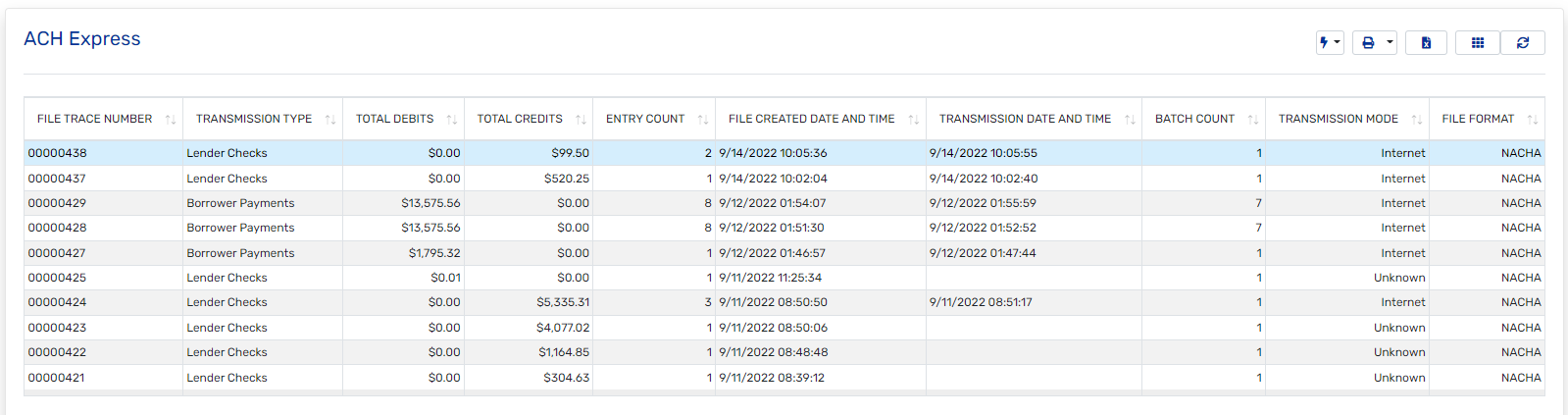

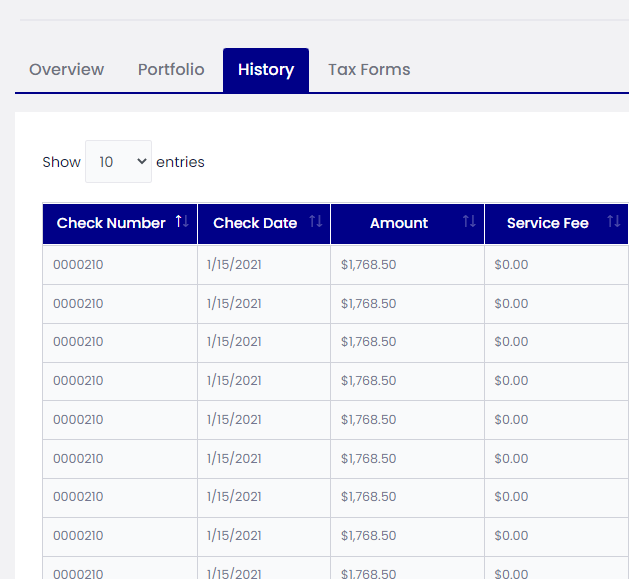

The Mortgage Office Software 2023 Reviews Pricing Demo

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Marginal Vs Effective Tax Rate Top 8 Differences To Learn Infographics

The Mortgage Office Software Reviews Demo Pricing 2023

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction A 2022 Guide Credible

Total Debt Service Ratio Explanation And Examples With Excel Template